Bookkeeping

What Is Accounts Receivable: Understanding Your AR Accounts

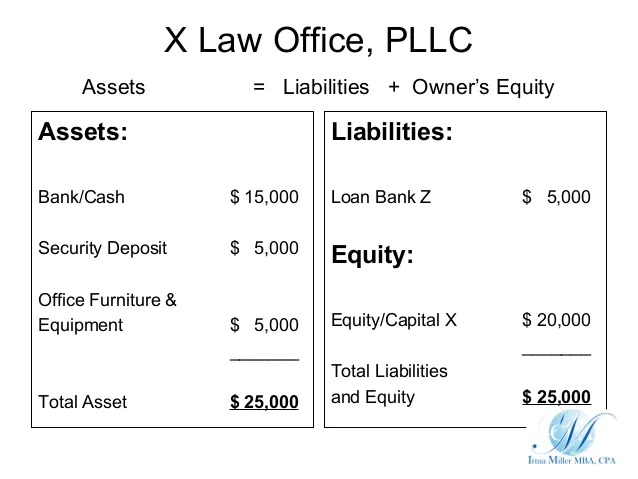

Accounts receivable and accounts payable are essentially on opposite sides of the balance sheet. While accounts receivable is money owed to your company (and considered an asset), accounts payable is money your company is obligated to pay (and considered a liability). Unreliable customers who don’t pay on time can lead your company to debt and bankruptcy if you don’t pay attention to what happens to your accounts receivable balance and whether all your invoices are paid. Keep track of your customers’ accounts so that you and your business never experience liquidity problems. Where accounts receivable describes money owed to a business in the form of sent but unpaid invoices, accounts payable represents the money a business owes in the form of received but unpaid invoices.

What Accounts Receivable (AR) Are and How Businesses Use … – Investopedia

What Accounts Receivable (AR) Are and How Businesses Use ….

Posted: Sat, 01 Apr 2017 17:47:06 GMT [source]

This means that the full amount owed on the property may not be collected. In other words, it’s money that a company has a right to receive because it has provided a product or service. An aging schedule is a table that shows a company’s accounts receivable, ranging by due dates, which is usually created by accounting software. This schedule helps with tracking the upcoming payments from customers so a business owner knows when and what to expect. However big or small your business is, you’re familiar with the notions of accounts receivable and accounts payable as integral parts of accounting.

Difference Between Accounts Receivable and Accounts Payable

The seller may use its accounts receivable as collateral for a loan, or sell them off to a factor in exchange for immediate cash. Receivables are prized by lenders, because they are usually easily convertible into cash within a short period Understanding Accounts Receivable Definition And Examples of time. Last but not least, Synder offers instant actionable insights from your financial data with Synder Business Insights. Now you can track all the necessary metrics in one source of truth and use your data with confidence.

What is an example of an accounts receivable asset?

Let's take the example of a utilities company that bills its customers after providing them with electricity. The amount owed by the customer to the utilities company is recorded as an accounts receivable on the balance sheet, making it an asset.

With accrual accounting, you record a transaction regardless of whether the payment was made or not. Then you create an invoice that automatically makes a credit for this sale in the sales account and makes debit in the accounts receivable. Accounts receivable are current assets because of the short-term nature of standard payment terms. When the outstanding invoices are paid, their value turns into liquid working capital that the business can use.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

To clarify things, here’s an example illustrating how the accounts receivable process works. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

- When an invoice is issued to a customer, the seller debits the accounts receivable account (an asset account) and credits the sales account (a revenue account).

- Accounts receivable are current assets because of the short-term nature of standard payment terms.

- If the terms of the agreement allow for it, a note receivable may allow the seller to attach the assets of the customer and gain payment by selling the assets.

- They act as two sides of an equation – if you neglect either side, it will affect the financial health and stability of your venture.

- Typically, accounts receivables are due in 30 to 60 days and are considered overdue past 90.

Accounts payable on the other hand are a liability account, representing money that you owe another business. Also, numerous vendors, including Oracle, Workday and SAP, sell software for automating management of accounts receivable and integrating the process with an ERP (enterprise resource planning) system. In the fast-paced realm of e-commerce, accounting specialists have a unique role in ensuring the financial success of online businesses. Understanding the nuanced differences between revenue and earnings is paramount…

Understanding the accounts on your balance sheet: receivable vs payable

Let’s look at how accounts receivable is recorded and reported on the financial statements. If XYZ pays on time, i.e., thirty days later, ACME will increase cash by $10,000 while reducing accounts receivable by the same amount. Receivables financing solutions can significantly speed up cash flow, allowing businesses to invest the collected money more quickly.

If you have a good relationship with the late-paying customer, you might consider converting their account receivable into a long-term note. In this situation, you replace the account receivable on your books with a loan that is due in more than 12 months and which you charge the customer interest for. Here’s an example of an accounts receivable aging schedule for the fictional company XYZ Inc. For comparison, https://kelleysbookkeeping.com/fillable-form-940/ in the fourth quarter of 2021 Apple Inc. had a turnover ratio of 13.2. To record this transaction, you’d first debit “accounts receivable—Keith’s Furniture Inc.” by $500 again to get the receivable back on your books, and then credit revenue by $500. Let’s say your total sales for the year are expected to be $120,000, and you’ve found that in a typical year, you won’t collect 5% of accounts receivable.

AR is a vital part of a balance sheet because it represents bills that should be paid to a company and could require steps for collection. Credit is usually granted in order to gain sales or to respond to the granting of credit by competitors. Allowing more credit to customers can expand the number of potential customers for a business, resulting in an increased market share. This is an especially useful tactic when a competitor decides to reduce the amount of credit offered, so that a firm offering more credit is in a good position to attract them.